Eligibility

- To qualify for most benefits, you must initially have employment exceeding six months, with a time base of at least .50.

- Academic-year lecturers and coaches are eligible for benefits if appointed for a minimum of one semester or two consecutive quarters with a time base of .40 or greater.

- Affordable Care Act (ACA)—Employees who do not meet eligibility requirements listed above may qualify for health care under ACA.

- If you do not meet any of the eligibility criteria above, you may still be eligible to enroll in many of the voluntary plans. Learn more here.

Benefits Plans for 2025

CalPERS is your Health Benefits Officer and administers health insurance coverage for CSU employees. If you choose to change your health plan for 2025, you will need to make with change with your campus. Visit your campus specific Open Enrollment page for more information.

The state employer contribution amounts for 2025 are:

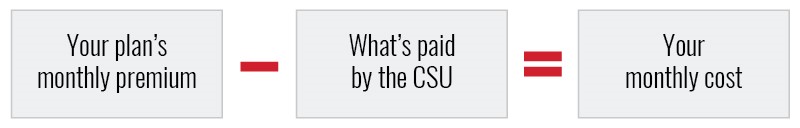

Monthly Cost of Coverage

| Employee Only | $1,060

| $1,065

|

| Employee + 1 | $2,039

| $2,049

|

| Employee + 2 or more | $2,551

| $2,571

|

Refer to the documents below to determine your monthly plan costs:

CalPERS Health Plan Information

Health Plan Rate Guide

You can contact CalPERS at (888) CalPERS or (888) 225-7377 or by visiting

calpers.ca.gov.

Delta Dental

The CSU pays 100% of the monthly premium cost for dental coverage for you and your eligible dependents, including a spouse or a registered domestic partner and/or children up to age 26.

When it comes to choosing a dental plan, you want your benefits to fit the needs of you and your family. Delta Dental PPO and DeltaCare USA both offer comprehensive dental coverage, quality care and excellent customer service.

Learn more about Delta Dental on their

flyer or visit their

website.

Current Enhancements for the Delta Dental PPO Plan includes:

- When you visit a PPO dentist, your diagnostic and preventive services (such as cleanings and exams) will not count toward your maximum.

- Enhanced coverage has been added for gum disease associated with a number of diagnosed systemic conditions (diabetes, heart disease, HIV/AIDS, rheumatoid arthritis or stroke).

Delta Dental PPO

This plan allows you to select the dentist of your choice. Both you and Delta Dental have a shared responsibility of paying the dentist for services rendered. If you choose a dentist who participates in the Delta Dental PPO network and/or the Delta Dental Premier network in California, claims will be filed on your behalf.

Please note: If you select a dentist from the Delta Dental PPO Network, you will pay less in out-of-pocket expenses.

DeltaCare USA

A prepaid dental health maintenance organization (DHMO) is available for California residents only. All covered dental services must be performed by DeltaCare USA panel dentists. No claim forms are required. Each covered dental service has a specific copayment amount and several services are covered at no charge. You will receive an identification card and welcome letter, which lists your DeltaCare USA panel dentist. You may change your assigned dentist by contacting DeltaCare USA.

For additional information, visit their

website, or call (800) 626-3108 if you are enrolled in the Delta Dental PPO Plan. Call (844) 519-8751 if enrolled in the DeltaCare USA Plan.

Vision Service Plan (VSP)

Eye exams are an important part of overall health care for the entire family. The

Vision Benefits Summary on the next page may help you decide which plan best fits the needs of you and your family.

The VSP offers a large network of contracting providers, including optometrists and ophthalmologists. When a contracting network provider is used, the care is considered “in-network.” Out-of-pocket costs will be less, and the highest level of benefits is received. If a provider outside the network is used, the care is considered “out-of-network.” Coverage is still provided, but the out-of-pocket costs will be significantly higher. Learn more at their

website or by calling (800) 877-7195.

Premier Plan Eligibility

Eligibility requirements are the same across all plans (health, dental and vision) and defined in the Open Enrollment Brochure under eligibility. However, unlike with health and dental, the Premier Plan requires all dependents to also be enrolled in the Premier Plan coverage or they will lose their Basic vision coverage. You cannot enroll in the Basic and Premier vision plans at the same time or split enrollments by leaving any dependents in the Basic vision plan.

Monthly Cost of Coverage

| Employee Only | $0 | $5.06

|

| Employee + One | $0 | $17.08

|

| Employee + Family | $0 | $31.73

|

Voluntary Benefits

Health Care Reimbursement Account Plan

This plan allows you to set aside a portion of your pay on a pretax basis to reimburse yourself for eligible health, dental and vision care expenses for you, your spouse/registered domestic partner and eligible dependent(s). You may contribute up to $3,200 for the 2025 plan year through payroll deduction.

Enrollment in the Health Care Reimbursement Account (HCRA) is required each year along with your designated contribution amounts. The 2025 monthly maximum is $266.66. ASIFlex is the claims administrator for this plan.

Learn more about the HCRA plan in the brochure.

Debit Card

The ASIFlex Card (a limited use pre-paid debit card) provides an easy way to pay for out-of-pocket health care expenses for you, your spouse, and any tax dependents. The advantage of the card is that you do not have to pay with cash or a personal credit card. The ASIFlex Card will allow you to pay directly from your health care account and can be used at health care providers that accept VISA and certain retail merchants that inventory eligible health care products.

ASI Flex Mobile App

You can check your balance from the palm of your hand with the ASIFlex Mobile App! Submit claims from anywhere, anytime. The app is available to download in the Apple Store and Google Play.

FSA Store

Employees can purchase eligible products and services through the Flexible Spending Account (FSA) site, called

FSAstore. The

FSAstore has the largest inventory of FSA-eligible products and services on the web. It’s a website you can trust to provide competitive pricing and quick turnaround for Flexible Spending Account information and shopping. Cardless pay is now available through the FSAstore by simply choosing the ASIFlex Payment option during the checkout process. Most FSA debit cards, as well as all major credit cards are accepted. Please note: Although it accepts FSA debit cards, ASIFlex might require a receipt for your purchase to substantiate the claim.

Dependent Care Reimbursement Account Plan

The Dependent Care Reimbursement Account plan (DCRA) allows you to set aside a portion of your pay on a pretax basis to reimburse yourself for childcare expenses for your eligible dependent child(ren) under the age of 13. Additionally, if you have an older dependent who lives with you and requires assistance with day-to-day living and is listed as a dependent on your annual tax return, you can claim these eligible expenses through your DCRA. You may contribute up to $5,000 each plan year ($2,500 if married, filing a separate tax return) through payroll deduction. Neither contributions nor reimbursements are taxed. Enrollment in the DCRA is required each year along with your designated contribution amounts. The 2025 monthly maximum amount is $416.66. ASIFlex is the claims administrator for this plan.

Learn more about the DCRA plan in the brochure.

Critical Illness Insurance

Group Critical Illness Insurance is offered through The Standard, which provides a lump-sum payment to cover out-of-pocket medical expenses and costs associated with life changes following the diagnosis of a covered critical illness. In addition, there are cash benefits for specified health screenings. You and/or your spouse/registered domestic partner must be between the ages of 18-64 and enrolled in a health insurance plan to participate in this plan. Employees may only enroll or cancel during Open Enrollment. To learn more about this benefit and/or enroll, go to their

website or call (800) 378-5745.

Accident Insurance

Accidents can happen when least expected, and while they can’t always be prevented, you can have the financial support to make your recovery less expensive and stressful. This insurance, provided by The Standard, can help with out-of-pocket expenses such as deductibles, copays, transportation to medical centers, and more. Employees may only enroll or cancel during Open Enrollment. To learn more about this benefit and/or enroll, go to their website or call (800) 378-5745.

Voluntary Life Insurance

You have the opportunity to purchase group life insurance for you and your eligible dependents. Employees have the opportunity to enroll or increase supplemental life insurance at any time. However, evidence of insurability may be required. Employees may enroll or cancel at any time. To learn more about this benefit and/or to enroll, go to the

website or call (800) 378-5745.

New for 2025, The Standard Insurance will allow eligible active members the opportunity to enroll in Voluntary Life insurance (up to $100,000 for self and/or spouse/registered domestic partners for up to $50,000) without proving Evidence of Insurability. If you currently have less than $100,000 of coverage or you are not currently enrolled, you can apply for this enhanced benefit. To learn more, go to the

website or call (800)378-5745. Note: Previously declined employees or spouses/registered domestic partners will need to provide satisfactory Evidence of Insurability for this enhanced benefit.

You can view The Standard’s recorded webinar reviewing the Guarantee Issue Voluntary Life insurance, as well as their other products, here.

Voluntary Long-Term Disability (LTD)

You have the opportunity to purchase a level of group disability insurance with either a 30-day or 90-day waiting period. Employees automatically enrolled in the CSU employer-paid LTD plan are not eligible to participate in this voluntary plan. Employees may enroll or cancel at any time. To learn more about this benefit and/or to enroll, go to the

website or call (800) 378-5745.

Voluntary Accidental Death and Dismemberment (AD&D) Insurance

You are eligible to purchase group Accidental Death and Dismemberment (AD&D) insurance that covers you and your dependents in the event of death or dismemberment as a result of a covered accident. You may elect up to $1 million in coverage. Coverage for spouse/registered domestic partner and dependent child(ren) coverage are also available. Employees may enroll or cancel at any time. To learn more about this benefit and/or to enroll, go to the

website or call (800) 378-5745.

You can’t predict the future, but you can plan for it. For $16.95 a month via payroll deduction, ARAG can provide you and your eligible dependents legal coverage. An ARAG® legal insurance plan isn’t just for the serious issues. It’s for events you plan for, like getting married or creating a will. Or the unexpected situations, like a traffic ticket or landlord dispute. Network attorney fees are 100% paid in full for most covered matters. Benefit from a wide range of coverage and services to protect you and your loved ones. Employees can only enroll during open enrollment. If prompted, please provide policy ID number 19061csu. To

learn more about this plan and enroll, go to the

website or call (800) 247-4184.

The CSU provides you the opportunity to participate in the 403(b) Supplemental Retirement Plan (SRP). The SRP is a voluntary program that can help you save money on taxes, invest in your future and supplement your income in retirement. By contributing into the CSU 403(b) SRP, you can improve your chances of reaching your retirement goals. Employees may enroll or cancel at any time.

Whether retirement is a long way off or right around the corner, by participating in the CSU 403(b) SRP, you could make a big difference in preparing for your future. Start with what you can and build from there. The important thing is that you start!

There are two ways you can contribute:

Pre-tax Option

Save for retirement by investing monthly pre-tax contributions in tax-deferred investments. Pre-tax contributions mean more savings go toward your retirement goals than after-tax savings.

Roth Contribution (After-Tax) Option

Unlike a traditional pre-tax 403(b), a Roth 403(b) allows you to contribute after-tax dollars and then withdraw tax-free dollars from your account when you retire.

Advantages of Saving in the CSU 403(b) SRP

- Easy and convenient—Contributions are automatically deducted from your pay.

- Tax-advantaged—Both pretax and Roth options available.

- Variety of investment options—It’s easy to find an investment strategy that helps you meet your goals.

- Guidance and education—Free consultations with Fidelity retirement planners are available at all 23 campuses.

- Time is an asset—The sooner you start saving toward retirement, the more you benefit from compounding interest.

- Consolidate your retirement assets—Your campus Fidelity retirement planner can assist you in rolling over your balances from previous employers or your other CSU 403(b)s.

How to Enroll

You may enroll in the plan at any time. You can:

- Call Fidelity at (800) 642-7131 and mention CSU plan number 50537

- Complete a paper form, available at your campus benefits office

- Go to the website

- Click on the “Enroll Now” button

- Enter your information, including CSU plan number 50537

For More Information

- Visit our

website

- Visit your campus benefits office

- CSU employees are entitled to complimentary one-on-one consultations with a Fidelity Retirement Planner on campus. Schedule your appointment by calling (800) 603-4015.

Regular review of your contributions and investment elections keep you on track towards reaching your retirement goals.

Discounted auto, home and renters insurance is offered exclusively to all CSU employees (excluding rehired annuitants and students) through California Casualty. Employees can save an average of over $500 and receive unique benefits like: free/waived deductible if your vehicle is hit/vandalized on campus, identity theft protection, 12-month rate lock guarantee, no charge personal property coverage up to $500 and payroll deduction available at no cost to active employees or monthly E-Z Pay Plans with skip payment options.

Employees can enroll at any time. For more insurance information, safety resources or to get a quote,

see their flyer, visit their

website, or call (866)

680-5142.

Whether they have two legs or four, every family member deserves quality health care. That’s why this pet health insurance gives you the freedom to use any vet, anywhere, including specialist and emergency providers. Nationwide offers various benefit options for your pets. This insurance can cover your pet’s accidents, illness and even preventive care and wellness services. Plans are available for dogs, cats, birds, small mammals and exotics (such as reptiles). Employees may enroll or cancel at any time. To learn more about this plan and/or to enroll, visit their

website or call (877) 738-7874.