Benefits Plans for 2025

CalPERS is your Health Benefits Officer and administers health insurance coverage for CSU retirees. You may change your health plan online during Open Enrollment by logging onto

my|CalPERS and following the instructions.

You may also call CalPERS at 888-225-7377 to make changes. Complete the

CalPERS Health Enrollment Retirees (PDF) form before calling.

State Employer Contribution Amounts

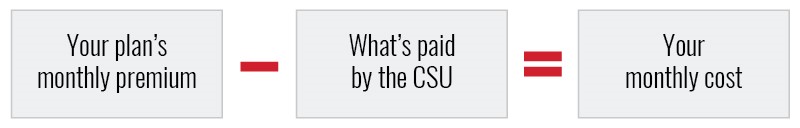

The state pays a portion of your health insurance premium. You must pay the difference between the state contribution amount and the premium for the health plan in which you’re enrolled.

The state employer contribution amounts for 2025 are:

| Retiree Only | $1,060

|

Retiree + One

| $2,039

|

| Retiree + Two or More | $2,551

|

Find your plan’s monthly premium on the CSU Retiree

Rate Sheet.

Additional CalPERS health plan information can be found here:

2025 In State Health Plan Rates

2025 Out of State Health Plan Rates

CalPERS maintains the dental benefit enrollment records for all eligible CSU retirees and processes retirees’ dental enrollments.

Voluntary Dental Enhanced Plans:

You can now choose between the Basic Plans (Delta Dental PPO Basic, DeltaCare USA Basic) (at no cost) and the Enhanced Plans (Delta Dental PPO Voluntary Enhanced II, Delta Care USA Voluntary Enhanced). For an additional monthly fee, you can enroll in the same Enhanced Plan you had as a California State University active employee. If you want to keep the same type of plan (Delta Dental PPO vs DeltaCare USA) but want to enroll in the enhanced coverage, make sure to select the correct enhanced plan (see the chart below). If you are uncertain which plan you are currently enrolled in (Delta Dental PPO Basic or DeltaCare USA Basic), contact Delta Dental or CalPERS (contact information is below). You may also choose to enroll in Basic coverage if you are currently enrolled in Enhanced coverage during open enrollment. Keep in mind, you and your dependents must be enrolled in the same type and level of coverage.

| Delta Dental PPO Basic | → | Delta Dental PPO Voluntary Enhanced II |

DeltaCare USA Basic

| →

| DeltaCare USA Voluntary Enhanced |

Compare the dental plans for CSU retirees:

Retiree Dental Comparison Charts (PDF)

To enroll in the Enhanced Plan, Basic Plan, or make other changes, complete the

CSU Retiree Dental Change/Enrollment Form and fax or mail to CalPERS.

For more information about the plans or your current coverage, visit Delta Dental’s website at

Delta Dental or call Customer Service at 800-626-3108 for Delta Dental PPO and 844-519-8751 for DeltaCare USA.

If you have questions regarding your enrollment or eligibility, contact CalPERS, Member Account Management Division at 888-225-7377 or visit

CalPERS.

FAX THIS FORM TO: (800) 959-6545, or

MAIL THIS FORM TO:

CalPERS – Health Account Management Division

P.O. Box 942715 - Sacramento, CA 94229-2715

To be processed, this form must be faxed or received by CalPERS no later than October 11, 2024.

To keep your current Plan, no action is required. You and all your eligible dependents will be enrolled in the same plan.

|

Dental Plan Name |

|

Gross Premium |

Employer Share |

Retiree Cost |

Delta Dental PPO Voluntary Enhanced II

| Retiree Only

Retiree + One

Retiree + Family

| $46.15

$86.82

$169.33 | $30.45

$57.52

$115.49 | $15.70

$29.30

$53.84 |

| DeltaCare USA Voluntary Enhanced | Retiree Only

Retiree + One Retiree + Family

| $25.34

$41.63

$61.42 | $18.85

$31.08

$45.97 | $6.49

$10.55

$15.45 |

The CSU pays 100 percent of the monthly premium cost for the Basic Plan dental coverage for all retirees and their eligible dependents, which includes a spouse or registered domestic partner and/or children up to age 26.

Delta Dental PPO Plan Enhancements Reminder

Diagnostic and Preventive (D&P) Waiver for the Delta Dental PPO Basic Plan

When you visit a PPO dentist, your diagnostic and preventive services (like cleanings and exams) will not count against your annual maximum. No action necessary to receive this benefit.

|

Without D&P Maximum Waiver | $300.00 | $100.00 | $1,200.00 |

|

With D&P Maximum Waiver | $300.00 | $100.00 |

$1,500.00 |

Diagnostic and Preventive (D&P) Waiver for the Delta Dental PPO Voluntary Enhanced Plan

When you visit a PPO dentist, your diagnostic and preventive services (like cleanings and exams) will not count against your annual maximum. No action necessary to receive this benefit.

|

Without D&P Waiver | $350.00 | $100.00 | $1,650.00 |

|

With D&P Waiver | $350.00 | $100.00 |

$2,000.00 |

More information:

Diagnostic-Preventive Waiver for Retirees (PDF)

SmileWay Wellness Benefit

The SmileWay Wellness Benefit offers enhanced coverage for retirees who qualify as “higher risk” (meaning those with a diagnosed medical condition such as amyotrophic lateral sclerosis (ALS), cancer, chronic kidney disease, diabetes, heart disease, HIV/AIDS, Huntington’s disease, joint replacement, lupus, opioid misuse and addiction, Parkinson’s disease, rheumatoid arthritis, Sjogren’s syndrome or stroke).

Expanded coverage includes one periodontal scaling and root planning procedure per quadrant of the mouth, per calendar year, covered at 100 percent. Also included is four (4) of any combination of yearly cleanings or periodontal maintenance. To use this benefit, retirees must opt in by calling Delta Dental at 800-626-3108

More information:

SmileWay Wellness Benefits for Retirees (PDF)

The CSU and Vision Service Plan (VSP) offer you a choice of two vision plans: Basic or Premier. The VSP Premier plan offers a higher level of benefits for lenses, contacts and frames.

Use the

2025 VSP Retiree Benefit Summary (PDF) to determine which plan best suits your vision needs.

Monthly Vision Costs

The cost is deducted directly from your state retirement warrant. If you don’t have enough in your warrant to cover the cost, you will be billed directly by VSP.

Retiree Only

| $5.10

| $14.80

|

| Retiree + One | $9.31

| $27.63

|

| Retiree + Family | $9.98

| $29.64

|

There are two ways to enroll:

- Complete the online enrollment form on the

VSP website.

- Call VSP at 800-877-7195 and speak to a representative.

Legal troubles can happen to anyone. ARAG legal coverage is paid directly to the vendor at a monthly rate of $16.95. ARAG offers you access to local network attorneys who can help you address life’s legal situations. Plus, network attorney fees are 100% paid in full for most covered matters. ARAG legal plan coverage can only be enrolled in during Open Enrollment.

CSU Retirees have 60 days to enroll becoming effective the first of the month following date of separation. Retirees can enroll in the ARAG legal plan during the CSU annual open enrollment period.

To enroll or learn more about this plan, please

review this flyer or visit,

ARAG.

View more information on the

ARAG At A Glance Flyer.

CSU retirees are able to enroll, change or cancel the above benefits during Open Enrollment for plan year 2025. See

Other Benefits for a complete listing of benefits available to retirees.