CalPERS is your Health Benefits Officer and administers health insurance coverage for CSU retirees. You may change your health plan online during Open Enrollment by logging onto

my|CalPERS and following the instructions.

You may also call CalPERS at 888-225-7377 to make changes. Complete the

CalPERS Health Enrollment Retirees (PDF) form before calling.

State Employer Contribution Amounts

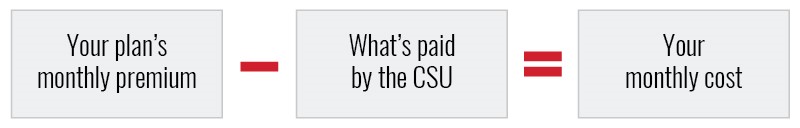

The state pays a portion of your health insurance premium. You must pay the difference between the state contribution amount and the premium for the health plan in which you’re enrolled.

The state employer contribution amounts for 2025 are:

| Retiree Only | $1,060

|

Retiree + One

| $2,039

|

Retiree + Two or More

| $2,551

|

Find your plan’s monthly premium on the CSU Retiree Rate Sheet

Additional CalPERS health plan information can be found here:

New for 2025:

Health Plan Rate Changes

Effective January 1, 2025, rates for most health plans will change.

PERS Gold and PERS Platinum

Effective 2025, Blue Shield of California will be the new administrator for all PPO plans. For members currently in a basic plan, they are partnering with Included Health to provide member services, including answering inquiries, guiding members to the most appropriate in-network and high-quality providers, and providing care coordination services for members, particularly those with complex health conditions. Included Health will also expand access to care through their supplemental virtual primary care and behavioral health care services. There are no changes to copays, coinsurance, or deductibles with the transition to Blue Shield.

Health Plan Expansions

- Blue Shield Trio will expand to Contra Costa county and select zip codes in Shasta county.

- Health Net Salud y Más will expand into Imperial county.

- Kaiser Permanente will expand into select zip codes of Monterey county.

- UnitedHealthcare Harmony will expand into Napa county and select zip codes in Contra Costa and Solano counties.

Health Plan Exits

The Anthem Blue Cross Del Norte EPO plan will no longer be offered. Members that do not elect a health plan change will be automatically enrolled in Blue Shield Access+, effective January 1, 2025.

Health Benefit Design Changes

- Doula Benefit for all Pregnant and Postpartum Members - New benefit for all pregnant and postpartum Basic plan members to receive health education, advocacy, physical and emotional nonmedical support before, during and after pregnancy, miscarriage, stillbirth and abortions

- Travel Benefit for Medically Necessary Care - Update to standardize travel and lodging coverage for eligible medically necessary services including, but not limited to abortion services, gender affirming care, complex surgeries, and cancer care that cannot be accessed within 50 miles from the member’s residence for all Basic and Medicare plan members, up to $5,000 per occurrence. This includes transportation, lodging and meals for the member and a companion (both parents/guardians when patient is under 18).

- For PORAC health plan only – Combine acupuncture and chiropractic visits to a 20-visit limit. Physical and occupational therapy have no visit limitations.

Understanding Medicare

Medicare is health insurance for people 65 or older, under age 65 with certain disabilities, or individuals with End-Stage Renal Disease (ESRD). The

Social Security Administration oversees Medicare eligibility and enrollment. For CSU purposes, the

CalPERS website and

Medicare Enrollment Guide will be your starting point for Medicare related inquiries.

Overview

Medicare is not optional in retirement if you are eligible to enroll in Medicare Part A and B. If eligible, Medicare will become your primary coverage and your CalPERS health coverage will become secondary.

Medicare is made up if four parts; Part A (Hospital), Part B (Medical), Part C (Medicare Advantage plans) and Part D (Prescription drugs). Part C is for HMO’s only, and CalPERS health plan members

should not enroll in Part D. All CSU retirees (and/or dependents) 65 or older will need to enroll in either Medicare Part A and B or Medicare Part C, depending on your health plan.

If you are eligible for premium-free Medicare Part A,

you must enroll in Medicare Part A and Part B and transfer to a CalPERS Medicare health plan. For information regarding eligibility, visit the

CalPERS Medicare website or contact your local Social Security Office.

If you are ineligible for Medicare Part A and B,

you must complete the

Ineligibility of Medicare Certification Form and return it to CalPERS, in order to remain in the CalPERS basic health plan as a CSU retiree (or dependents) over 65.

Below are the various scenarios indicating when you will need to enroll in Medicare Part B:

- If you’re active and 65 and over, your CalPERS medical coverage remains your primary health plan while employed.

- If you have a spouse 65 and over AND they are currently enrolled in your CalPERS health coverage, CalPERS will remain their primary health plan as long as you are employed with the CSU – no action is required.

- If you are active and under 65, with a spouse/registered domestic partner who is 65 or older OR has a social security approved disability, you will need to complete a Special Enrollment Period (SEP) application.

- You will need to complete

this form. Then, at your direction, the campus will need to complete sections A and B of

this form and provide it back to you. Once complete, you will need to submit your and the campus forms to the Social Security Office. The campus will be called to attest to the content on their form.

- If you plan to retire and you and your spouse/registered domestic partner are 65 or older, you must contact your campus benefits office two months before your intended retirement date, or as soon as possible, to prevent a lapse in coverage.

- If you turn 65 in retirement, CalPERS will notify you four months before your 65th birthday to notify you of the requirements to continue your health plan coverage.

You

do not need to enroll in Medicare Part B if you are still working and have active employer group health coverage (ex. CSU health coverage) or if your spouse is still working and you’re covered under their active employer group health coverage.

If you or your spouse/register domestic partner are retired and over the age of 65 and had their CalPERS health coverage cancelled, you likely did not provide CalPERS with

your

Certification of Medicare Status Form within 60 days of your retirement date. If you are Medicare eligible, please enroll in Medicare Part A and B and complete the

Certification of Medicare Status Form and submit

it via your myCalPERS account or in person at your local CalPERS office.

Cost of Medicare

The cost of Medicare is dependent on your age and your dependents, if applicable. Rates can be found on the

CalPERS website. Keep in mind that the CalPERS website does not reflect the employer share.

Reimbursement of Premiums

As a CSU retiree, if you or your dependents are eligible for Medicare Part B reimbursement, CalPERS will automatically reimburse the eligible amount of the standard Medicare Part B premium, beginning the date of your enrollment into a CalPERS Medicare health plan. Your reimbursement will be listed on your warrant as “Medicare Reimbursement.”

You can learn more about this reimbursement for high income earners on the

CalPERS Medicare website.

You can visit the

CalPERS Medicare website, Medicare Enrollment Guide or review the

Medicare and Your CalPERS Health Benefits Webcast video for more information.